This regulation will potentially impact the shipping industry even more than the ETS and may require even greater urgency for the stakeholders to take the necessary measures, i.e., aligning their contractual framework – such as charter parties, ship management agreements and fuel supply agreements – even before the main body of the regulation enters into force in 2025. We will in this and upcoming newsletters outline the impact of the FuelEU and what actions stakeholders may take in order to be prepared.

The FuelEU Regulation[1] forms part of the EU’s Fit for 55 agenda intended to fight climate change by reducing Greenhouse Gas (“GHG”) emissions in shipping. The FuelEU Regulation supplements the EU Emission Trading Scheme (“ETS”)[2] and is aligned with the same data verification regime under the MRV Regulation[3].

The FuelEU Regulation sets out transformative targets of gradually replacing fossil fuels with biobased, power-to-X and other alternative fuels towards 2050. The fuel requirements will apply already from 1 January 2025 and, from 2030, vessels will be required to use onshore power supplied during port stays in the larger EU ports. Understanding the FuelEU Regulation is crucial to shipowners as the regulation will lead to a transformation of the propulsion of vessels in European waters.

As of 1 January 2025, the FuelEU regime will apply to commercial vessels with a gross tonnage (”GT”) of more than 5,000 used for transport of cargo or passengers, regardless of the flag. Similar to the ETS, FuelEU will not apply to offshore vessels and dredging vessels as these are deemed not be used predominantly for “transportation” purposes. The regulation does also not apply to fishing vessels, warships and other vessels used by the governmental authorities for non-commercial purposes.

The FuelEU Regulation follows the general geographical scope of the ETS. As shown in the figure below, the FuelEU regime will apply in respect of 100% of the energy used during calls at EU ports and on voyages between two EU ports (intra-EU) and 50% of the energy used on voyages between an EU and a non-EU port (extra-EU). The definitions of ‘voyages’ and ‘port calls’ mirror the terms in the ETS. A port call will qualify for the purposes of the regulation if cargo is loaded/unloaded or passengers are embarked/disembarked but not if it is a stop made solely to bunker, change crew or make STS-transfers outside ports.

Although the FuelEU Regulation is intended to be non-discriminatory, the exclusion of vessels with GT 5,000 or less will, however, potentially significant disrupt the competitive landscape in the near-shore, feeder or other markets which are dominated by vessels in the range both below and above the limit GT 5,000. It may for the foreseeable future create an incentive for the employment of vessels just below the limit to avoid the application of the regulation.

As with the ETS, the FuelEU may also create the incentive to call ports in non-EU countries in the near proximity of the EU (to thus limit the amount of energy consumption subject to the regulation). This incentive is partly outset by the transshipment rule which provides that port calls by container ships in certain ports will not count as port calls for the purpose of the EU Regulation. This rule will not apply to any other shipping segments.

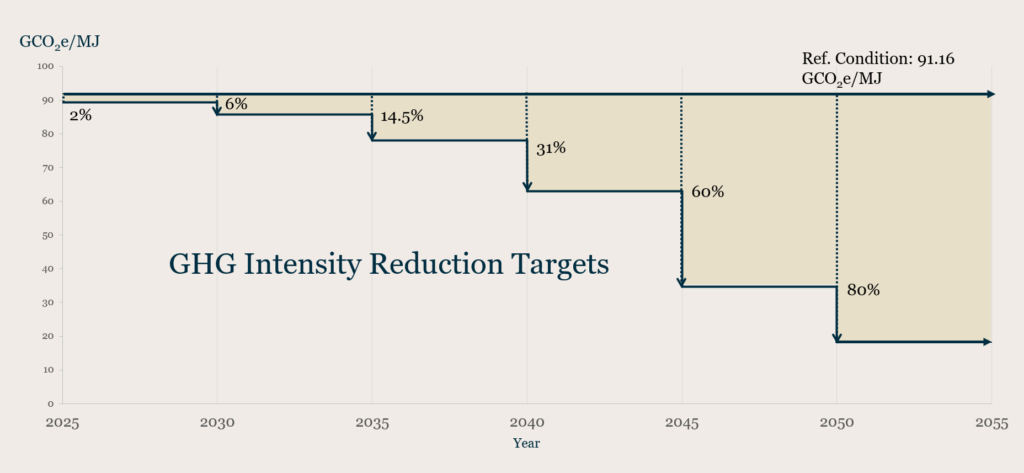

The main reduction targets under the FuelEU Regulatuon are tied to a reference of the fuel intensity rating of the GHG emissions (measured in grams (g) of CO2) relative to the energy (e) (measured in Mega Joule (MJ)) used onboard vessels. The baseline of 91.16 g CO2/eMJ is based on the MRV data for voyages performed in EU 2020. Under the Regulation, vessels’ GHG intensity rating is as main target to be reduced in steps, with a 2 % reduction in 2025 and up to, ultimately, an 80 % reductions by 2050 as shown in the figure below.

Vessels will, as a starting point, be non-compliant if the fuel used on board on a yearly average exceeds the limits set out above (e.g. 85.69g CO2/eMJ in 2030) in respect of the EU-voyages covered by the FuelEU Regulation (see above). The intensity factors are calculated on a “well-to-wake” basis which also take into account the GHG impact of the energy production, transport, distribution and use on board the vessels. This impact is to be documented and verified by independent certification procedures.

From 2025 to 2033, a multiplier of 2 may be used to reward ships using renewable fuels of non-biological origin (“RFNBO”) such as Power-to-X fuels. The purpose of the RFNBO-mulitplier is to incentivise the uptake of these fuels even in excess of the actual GHG reductions. Based on the uptake, availability and price of RFNBOs, a separate mandatory target on the use of RFNBOs in marine fuels may be instituted from 2034.

The FuelEU Regulation is generally technology-neutral as to the fuel used. The FuelEU Regulation does, however, provide that crop-based biofuels and other biofuels and biogas which do not fulfill certain sustantiability criteria will be given the same emission factors as the least favourable fossil fuels.

The FuelEU Regulation provides – perhaps to many industry stakeholders’ surprise – that the entity responsible for compliance is always the ISM company, i.e. the Document of Compliance (DoC) holder, irrespective of whether the DoC holder is the registered owner, a bareboat charterer or a third party technical manager.

In respect of the ETS, the EU Commission exercised an (arguably) vague power in the ETS Directive to regulate the “administration” of the “shipping company” by altering the definition of the “shipping company” altogether – from the ISM company (DoC holder) to the registered owner as the default responsible entity. The Commission still allowed for the registered shipowner to mandate the DoC holder to accept and assume the ETS responsibility. The EU Commission holds, however, no similar legislative power under the FuelEU Regulation. The EU should thus only be able to shift the responsibility from the DoC holder (e.g. a technical manager) to the registered owner or any other entity by way of adopting a legislative amendment through the Counsel and European Parliament. The Commission has made no indication that any such actions should be on the table. The Commission instead leaves it to the stakeholders to make the necessary arrangements on the allocation of the responsibilities and costs on a contractual basis.

The industry should therefore expect and plan for the DoC holder to be fully responsible for compliance with FuelEU. Parties may through contractual arrangements transfer the indirect responsibility to the registered owner. Similarly, the benefits or costs – arising from either over- or under compliance (as noted below) – can only be effectively allocated to, for instance, a time charterer – who is the entity actually responsible for the procurement of the required fuels – on a contractual basis. Irrespective of the contractual setup, it will still be the DoC holder who is responsible – towards the authorities – for full compliance with the FuelEU Regulation in respect of the vessels and, in the event of non-compliance, for the payments of the (very) significant penalities.

Based on the data and the verification process (as set out below) for the GHG intensity for the energy source used onboard for any given reporting period, each vessel will end up with a ‘compliance balance’ compared to the reduction targets being either a ‘compliance surplus’ (if over-compliant) or ‘compliance deficit’ (if under-compliant).

The FuelEU Regulation introduces various means for companies to benefit from a surplus and to handle any deficit to still ensure compliance with the FuelEU reduction targets, as applicable. These means are as follows:

If a vessel holds a surplus for any given reporting period (e.g. 2025), the company may ‘bank’ the surplus to be used to cover a deficit in the next reporting period (e.g. 2026) for the same vessel. Hence, banking is a method to store the value of a surplus (instead of selling the surplus through pooling, see below). There is no statutory expiration date on a banked surplus, which means that the surplus can be stored until the vessel is in risk for not reaching the yearly reduction target.

If the vessel holds a deficit, the company may borrow an advance compliance surplus of the corresponding amount from the next reporting period. This may be used to effectively postpone the costs of non-complying with the FuelEU Regulation in a specific reporting year. Borrowing is disincentivised by adding a multiplier of 1.1 from the vessel’s compliance balance in the following reporting period (thus making compliance in the next reporting period more difficult). Furthermore, the borrowing may not exceed 2% reduction from baseline (equal to the initial reduction target) and the mechanism cannot be applied for two consecutive reporting periods.

Under this mechanism, vessels with deficits may for any given reporting year be pooled with vessels with surpluses provided the pool’s total balance constitute a surplus. This pooling can be done not only in respect of the company’s own vessels but also with third parties’ vessels. The vessels need not have any operational or commercial collaboration. Thus, the pooling mechanism are not to be confused with the existing commercial pools. The incentive behind this mechanism is that the FuelEU Regulation explicitely allows companies to sell surpluses when pooling.

If the vessel holds a compliance deficit, the company may make the vessel compliant by paying the FuelEU penalty. The penalty is based on formula taking into amount of energy used on board and the difference between the actual GHG intensity and the target GHG intensity. As the reduction targets for GHG intensity will decrease over time, the penalties will increase if the vessel’s GHG intensity does not drop correspondingly. If the company decides to pay to comply for two or more consecutive reporting periods, the penalty is multiplied by 1+0.1 for each such year (e.g. a multiplier of 1.2 if the company has had a deficit for more two years), hence disincentivising the mechanism.

The expressed intention of the EU Commission is to reward over-compliance through the pooling mechanism for companies to recover the costs associated with the necessary investments made for improving the vessel’s fuel efficiency and using alternative fuels. The value of surpluses is uncertain as it will depend on supply-demand – relating to the level of over- and underperformancer. The value of pooling will though be effectively limited in the upper range of the costs of paying the FuelEU penalty (see (4) above).

No later than 31 August 2024, companies (DoC holders) will be required to submit a monitoring plan to their independent verifier, typically a classification society, for each vessel indicating the methods for the monitoring and reporting of the energy consumption and other relevant factors. The plan shall fulfill a wide range of requirements set out in the FuelEU Regulation and supplementary commission implementing acts. Later in 2024, the Commission will publish a standard monitoring plan which companies shall use to prepare the plans.

Going forward, the monitoring plan shall be updated in the event of material changes, such as a change to a new DoC holder, if the new measurement or sampling methods may affect the accuracy of the data or if the monitoring plan is in non-compliance with the FuelEU requirements. This will require parties to collaborate for instance in connection with ship sales or a change of the technical management.

From 1 January 2025, companies shall record a wide range of different data on the fuel/energy consumption in respect of each EU voyage. Companies are to compile all the data on an annual basis – in order to submit a data report known as the ship-specific ‘FuelEU report’ – enabling the verifer to verify compliance with the requirements and for the authorities to check the data and calculations.

Following each reporting year (first year: 2025), the verification process (first year: 2026) involves the verification of the data recorded in the reporting year, the calculation of the compliance balance and the recording of the data and results into the FuelEU database. The verification process is to be aligned with the existing MRV reporting. It involves both the company (DoC holder), the independent verifier and the national authorities. The annual verification circle includes broadly these steps:

The verification process entails that the industry has in principle only the month of April in the verification period to execute the final compliance strategy based on the compliance balance and, for instance, execute on the pooling of vessels with other companies to benefit from a surplus. Naturally, the parties may benefit from making the contractual arrangements prior to the reporting period and thereby prepare for the later, final decision on which compliance strategy to use.

Importantly, FuelEU is focused on the fuel and the GHG emission intensity of this fuel (unlike the CII and ETS dependent on total emissions). Owners may mainly enjoy benefits from making CAPEX investments relating to the engine to allow the fuel switch (e.g. dual-fuel engine) as this will improve the GHG intensity score. The vessel’s total energy consumption (and thus emissions) is still indirectly relevant as it determines the size of the potential surplus or deficit. CAPEX investments decreasing the overall emissions – e.g. anti-fouling – may either reduce the potential deficit (and thus the FuelEU penalty) or reduce the surplus (to be sold), depending on the GHG intensity emission factor. The CII and the ETS, conversily, will in all respects incentivise owners to make CAPEX investments to lower of total emissions.

The operational consequences of FuelEU will likely also be significant. Chiefly, the operators will have an incentive to use the newer ‘green’ fleet in EU waters and the older, less energy-efficient vessels in non-EU waters, augmenting the process of splitting the world fleet into the various regions and trades. Importantly, the operators’ decision making processes and fuel choices may be strongly affected by the contractual setup and the parties’ ability to transfer the costs of the FuelEU penalities to charterers. Many owners may consider obtaining binding pooling commitment from other vessels (and their DoC holders) as soon as possible to improve operational flexibility and provide clarity on the need for alternative fuels on EU voyages in order to ensure clarity on the compliance costs and benefits – long before the deadlines to execute pooling.

The ETS’ compliance regime was linked to the company (and not the vessel) allowing for enforcement actions against all vessels under the DoC of the responsible ‘company’ (e.g. a third party ship manager), involving some unique enforcement issues. As a buyer (taking over the DoC for the vessel), the ETS is ‘save’, however, as any non-compliance with the ETS did not stick to the vessel, only to the non-complying company.

It is not so with the FuelEU Regulation, which embodies a vessel-based compliance and sanctions regime. It means that a buyer will be responsible for any non-solved compliance deficits relating to the vessel. It also entails significant risks for owners with vessels in third party ship management. In this case, the owner risk enforcement action against the vessel (such as detention) if the DoC holder fails to pay the FuelEU penalty for two consecutive years, e.g. due to insolvency, causing the vessel not to obtain the FuelEU document of compliance. It is therefore important for the owners to ensure proper protection against the need for bearing unnecessary risks and costs.

While the overall framework for the sanctions relating to non-compliance is in place, the individual member states will need to introduce supplementary legislation on the measures. This leaves some room for member states to set out sanctions and enforcement risks not found on an EU-wide level.

As a fundamentally new regime with wide implications, few of the existing vessel and fuel-related contracts take the unique features of the FuelEU into account. Stakeholders should thus consider adjusting all charter parties, pool agreements, sale and purchase agreements, shipmanagement agreements and fuel supply agreements, among other contracts, whose duration extent into 2025 or beyond. As the ETS has shown, it takes time to prepare for everything not seen before.

Gorrissen Federspiel is actively engaged in the regulatory and contractual aspects of decarbonisation and sustainability in shipping, including IMO and EU regulations, and all related subjects.

[1] Regulation (EU) 2023/1805 of the European Parliament and of the Council of 13 September 2023 on the use of renewable and low-carbon fuels in maritime transport, and amending Directive 2009/16/EC (the “FuelEU Regulation”).

[2] Directive (EU) 2023/959 of the European Parliament and of the Council of 10 May 2023 amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union and Decision (EU) 2015/1814 concerning the establishment and operation of a market stability reserve for the Union greenhouse gas emission trading system (the “ETS Directive”).

[3] Regulation (EU) 2023/957 of the European Parliament and of the Council of 10 May 2023 amending Regulation (EU) 2015/757 in order to provide for the inclusion of maritime transport activities in the EU Emissions Trading System and for the monitoring, reporting and verification of emissions of additional greenhouse gases and emissions from additional ship types (the “MRV Regulation”).